Corporate Actions - where do they fit in the trade life cycle?

Corporate Actions is a collective term to describe the entitlement of a security holder. The securities can be Equity, Debt, Hybrid or other securities, including convertible securities. Any action taken by the company should affect the investors or stakeholders (not the company) for it to be qualified as a Corporate Action. Corporate actions also affect the holders of mutual funds and other collective investment schemes, and derivatives of securities.

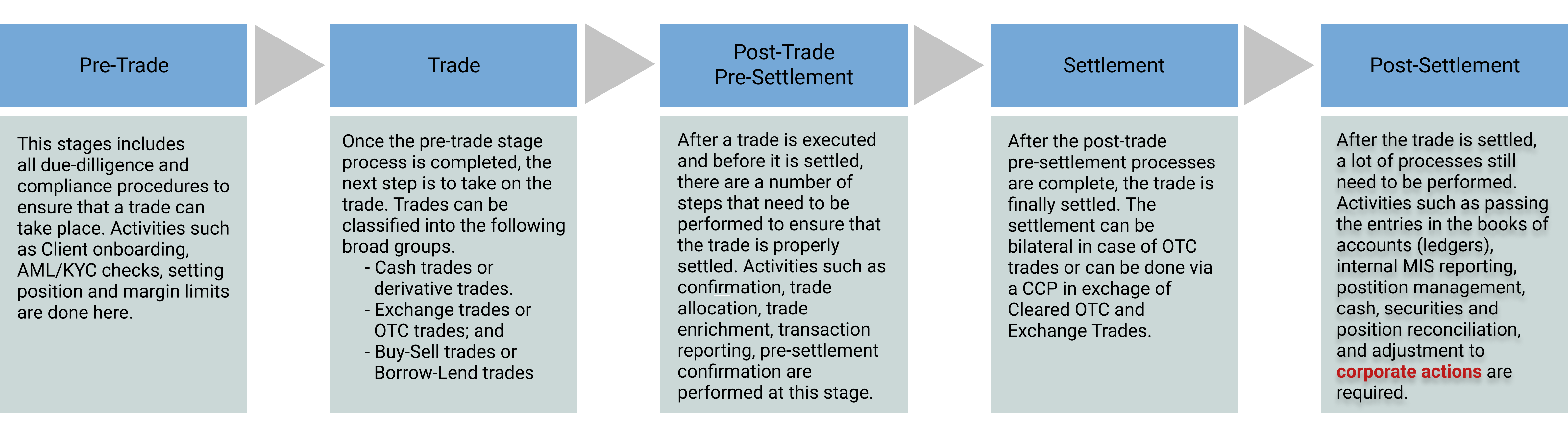

Corporate actions affects a person or company only when he/she/it has a position in the security on which the corporate action is initiated. If there is no position (exposure) to the security then the corporate action does not affect such a person or company, even though sometimes they may handle it (process it) for operational purposes. For example, we might have sold a security recently just before the record date and the issuer wrongly credits the dividend to our account instead of the current buyer of the security. In this case, we will have to pass-on the dividend to the new buyer. . In this sense, corporate is a part of the last stage of the trade lifecycle. The following diagram shows the involvement of corporate actions in the trade lifecycle.

Corporate action affects a person or company only when there is a position in the security. Position here refers to the exposure to the security, not the quantity of securities held.

Positions can be long or short. The below table shows the various positions that we can have in some common asset classes on which corporate action can occur.

| Position / Securities | Equity | Debt | Mutual Funds | Derivatives |

|---|---|---|---|---|

| Long | Yes | Yes | Yes | Yes |

| Short | Yes | Yes | No | Yes |

If we have taken a long position and subsequently a short position (or vice-versa) in the same security then our net position is square (zero). In such a case, we will not be affected by the corporate action, though we may need to handle it on some occasions for operational purposes. Otherwise, in general, we will not be affected by corporate actions if we do not have a position in security.

The trade life cycle (above) only shows the various stages in the life of a trade. It does not show the frequency of the activities involved in the trade lifecycle. The frequency of these differ based on asset class and type of trade. The following table show the frequency of these activities.

| Stage | Activity | Frequency | ||

|---|---|---|---|---|

| Cash Equities | Cash Bonds | Derivatives | ||

| Pre-Stage | AML/KYC Checks | In regular intervals | In regular intervals | In regular intervals |

| Documentation and Onboarding | Once | Once | Once | |

| SSI Setup | Frequency depends on the SSI change requests made | Frequency depends on the SSI change requests made | Frequency depends on the SSI change requests made | |

| Position and Margin limits setting | Ocasionally - depends on the clients trading relationship | Ocasionally - depends on the clients trading relationship | Ocasionally - depends on the clients trading relationship | |

| Trade | Pre-trade checks | Once | Once | Once |

| Trade | Once | Once | Once | |

| Post-Trade Pre-Settlement | Trade Confirmation | Once | Once | Once |

| Trade Allocation | Once | Once | Once | |

| Trade Enrichment | Once | Once | Once | |

| Trade and Transaction Reporting | Once | Once | Once | |

| Position and Gap checks | Once | Once | Once | |

| Pre-Settlement Confirmation | n.a. | n.a. | Once (applicable only to OTC Derivatives) | |

| Billing, Fees and Commissions | Once | Once | Once | |

| Clearing | Once | Once | Frequency depends on the number of payment dates | |

| Settlement | Transfer of cash | Once | Once | not applicable, unless settlement method is physical |

| Transfer of securities | Once | Once | not applicable, unless settlement method is physical | |

| Payment of net obligations | not applicable | not applicable | Frequency depends on the frequency of netting. For forwards, futures and options, there would be only one settlement. For swaps, there would be multiple settlements depending on the payment frequency. |

|

| Post-Settlement | Accounts/Books reconciliation | Once | Once | Once |

| Ledger Entries | Once | Once | Frequency depends on the MtM frequency | |

| Corporate Actions | Depends on the frequency of corporate actions | Depends on the frequency of corporate actions | Depends on the frequency of corporate actions | |